You are here:逆取顺守网 > airdrop

When Should I Cash Out My Bitcoin?

逆取顺守网2024-09-21 14:30:43【airdrop】3people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized cryptocurrency, has gained immense popularity over the year airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized cryptocurrency, has gained immense popularity over the year

Bitcoin, the world's first decentralized cryptocurrency, has gained immense popularity over the years. As the value of Bitcoin fluctuates, many investors wonder, "When should I cash out my Bitcoin?" This article aims to provide insights into the factors to consider when deciding the best time to cash out your Bitcoin investments.

Firstly, it is crucial to understand that the decision to cash out your Bitcoin should be based on your investment goals and risk tolerance. If you are looking for short-term gains, you may consider cashing out when the market is performing well. However, if you are a long-term investor, it may be more beneficial to hold onto your Bitcoin for a longer period.

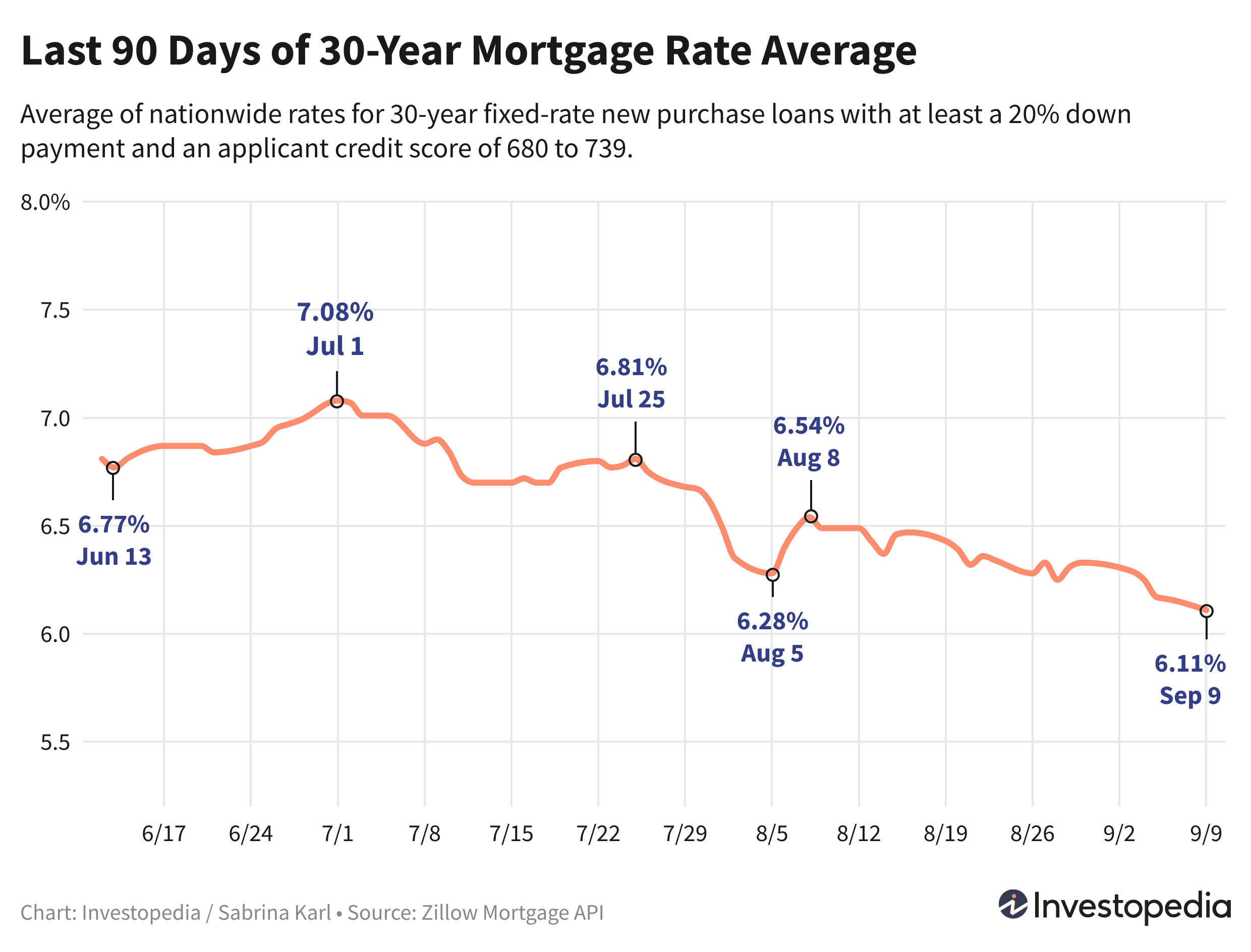

One of the primary factors to consider when deciding when to cash out your Bitcoin is market trends. Bitcoin's value has experienced significant volatility over the years, with periods of both rapid growth and sharp declines. It is essential to analyze market trends and identify potential opportunities for profit. Here are a few indicators that may help you determine the best time to cash out your Bitcoin:

1. Market Sentiment: Keep an eye on the overall market sentiment. If there is a general consensus that Bitcoin is overvalued or facing regulatory challenges, it may be a good time to cash out.

2. Historical Performance: Look at the historical performance of Bitcoin. If you have held onto your Bitcoin for an extended period and have seen substantial gains, it may be time to consider cashing out.

3. Market Indicators: Utilize various market indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), to identify potential buy and sell signals.

Another crucial factor to consider is your personal financial situation. If you require immediate cash or have other financial obligations, it may be necessary to cash out your Bitcoin. However, if you have a diversified investment portfolio and are comfortable with the risk, you may choose to hold onto your Bitcoin for longer.

It is also essential to consider the tax implications of cashing out your Bitcoin. Depending on your jurisdiction, you may be subject to capital gains tax on the profits from your Bitcoin investments. It is advisable to consult with a tax professional to understand the potential tax liabilities and plan accordingly.

In addition to market trends and personal financial considerations, it is crucial to stay informed about regulatory developments. Governments and financial authorities around the world are continuously working on regulations to govern cryptocurrencies. Changes in regulations can significantly impact the value of Bitcoin and your investment decisions.

Lastly, it is essential to remain disciplined and avoid making impulsive decisions based on emotions. The cryptocurrency market can be highly unpredictable, and panic selling can lead to significant losses. By sticking to a well-thought-out investment strategy and staying informed, you can make more informed decisions about when to cash out your Bitcoin.

In conclusion, determining the best time to cash out your Bitcoin requires careful consideration of market trends, personal financial situation, tax implications, and regulatory developments. By staying informed and disciplined, you can make more informed decisions about when to cash out your Bitcoin and achieve your investment goals. Remember, "When should I cash out my Bitcoin?" is a question that only you can answer based on your unique circumstances.

This article address:https://m.iutback.com/blog/19f59199389.html

Like!(851)

Related Posts

- Binance Export Complete Trade History Range: A Comprehensive Guide

- ### Understanding the BTC GDAX to Binance Fee Structure

- Bitcoin Wallet Amount Below Minimum Allowed BCH: What It Means and How to Address It

- Is Bitcoin Cash (BCH) Struggling for Recovery?

- Title: Decentralized Token Bridge Between Ethereum and Binance Smart Chain: A Game-Changer for Cross-Chain Transactions

- Bitcoin Price Soars as BBC News Reports on the Cryptocurrency's Resurgence

- Hey Google, What's the Price of Bitcoin?

- The Law of One Price Bitcoin: A Comprehensive Analysis

- How Much Money Can I Make with Bitcoin Mining?

- What's the Latest Price of Bitcoin: A Comprehensive Analysis

Popular

Recent

Bitcoin Cash Yahoo Finance: A Comprehensive Overview

Can I Connect Trust Wallet to Binance? A Comprehensive Guide

How to Set Up Bitcoin Wallet Coinbase: A Step-by-Step Guide

Does Bitcoin Increase in Value in Wallet?

Bitcoin Price is Going Up: What You Need to Know

What Price Will Bitcoin Fall To?

Does Bitcoin Receipts Convert to Cash?

The Impact of Bitcoin Mining Fee on the Cryptocurrency Market

links

- Disadvantages of Bitcoin Cash: A Closer Look at the Controversial Cryptocurrency

- Can I Short Sale in Binance: A Comprehensive Guide

- Disadvantages of Bitcoin Cash: A Closer Look at the Controversial Cryptocurrency

- Unlisted Coins on Binance: A Hidden Gem for Cryptocurrency Investors

- ABC Bitcoin Wallet Debug: A Comprehensive Guide to Troubleshooting Common Issues

- Emergency Adjustment Bitcoin Cash: A Strategic Response to Market Volatility

- Bitcoin Opening Stock Price: A Comprehensive Analysis

- Bitcoin Mining HW Comparison: Unveiling the Best Hardware for the Job

- Can I Short Sale in Binance: A Comprehensive Guide

- Bitcoin Wallet Key Finder: A Game-Changing Tool for Cryptocurrency Security