You are here:逆取顺守网 > markets

Tether Manipulating Bitcoin Price: The Controversial Issue That Divides the Cryptocurrency Community

逆取顺守网2024-09-21 05:29:28【markets】6people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the cryptocurrency market has experienced significant growth and volatility. Among airdrop,dex,cex,markets,trade value chart,buy,In recent years, the cryptocurrency market has experienced significant growth and volatility. Among

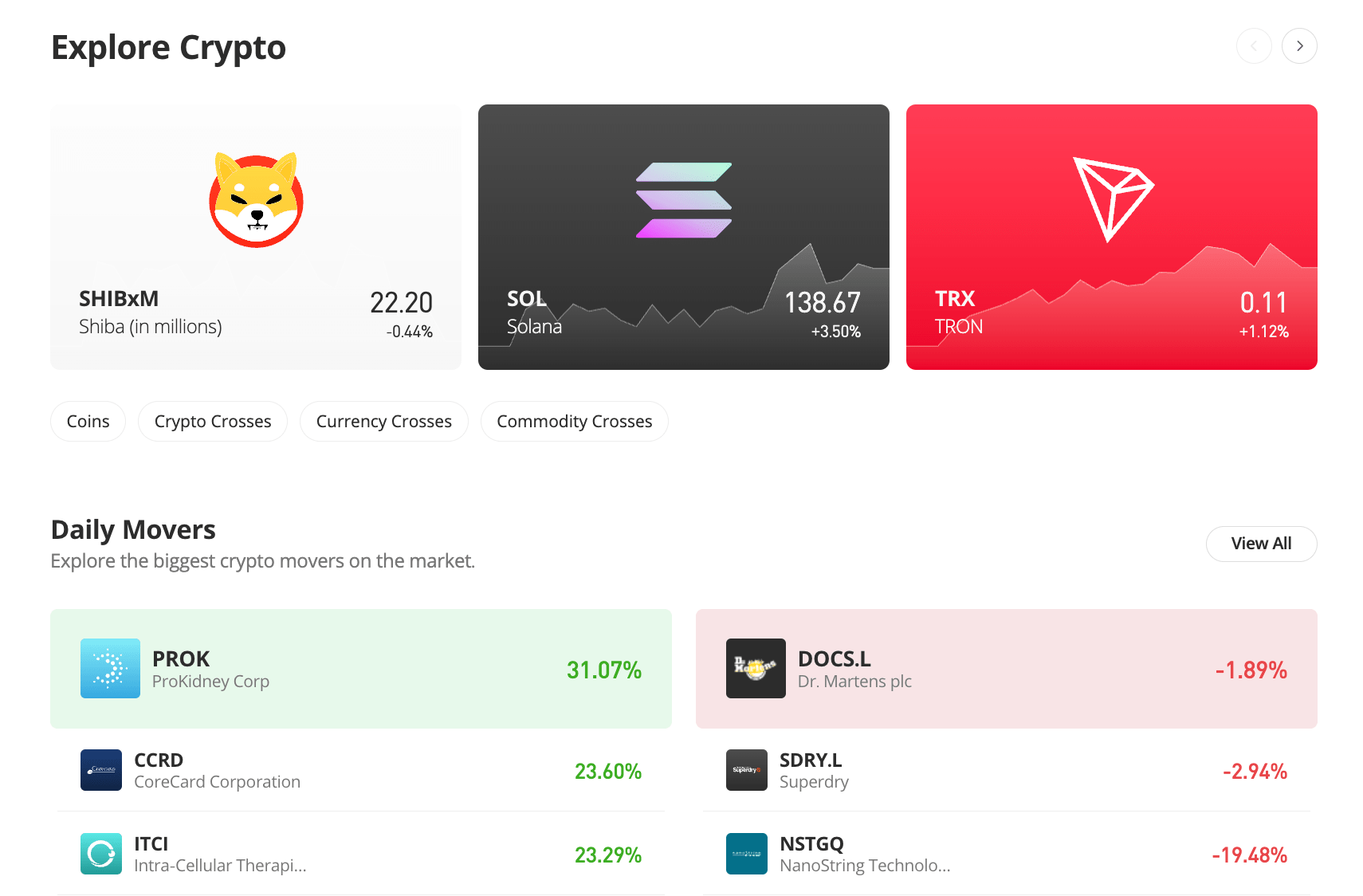

In recent years, the cryptocurrency market has experienced significant growth and volatility. Among the various digital currencies, Bitcoin remains the most prominent and influential. However, the rise of stablecoins, particularly Tether (USDT), has raised concerns about its potential manipulation of Bitcoin's price. This article aims to explore the issue of Tether manipulating Bitcoin price and its implications for the cryptocurrency community.

Firstly, it is essential to understand the role of Tether in the cryptocurrency market. Tether is a stablecoin that aims to maintain a 1:1 ratio with the US dollar. It is often used as a medium of exchange and a store of value, providing a sense of stability in an otherwise volatile market. Tether's market capitalization has grown exponentially, making it one of the largest stablecoins in the industry.

The concern arises from the fact that Tether is often used to trade Bitcoin. Many cryptocurrency exchanges and platforms accept Tether as a payment method, and it is also widely used for margin trading. This has led to the belief that Tether's supply and demand can influence Bitcoin's price.

One of the primary arguments against Tether manipulating Bitcoin price is the potential for market manipulation. Critics argue that Tether's creators, Bitfinex, have the ability to increase or decrease the supply of Tether, which can, in turn, affect Bitcoin's price. For instance, if Bitfinex were to suddenly increase the supply of Tether, it could lead to a surge in demand for Bitcoin, driving up its price. Conversely, if Bitfinex were to reduce the supply of Tether, it could lead to a decrease in demand for Bitcoin, causing its price to plummet.

Another concern is the lack of transparency surrounding Tether's reserves. Tether has faced criticism for not fully disclosing the assets backing its stablecoin. This lack of transparency raises questions about the actual value of Tether and its potential impact on the market. If Tether's reserves are not as strong as advertised, it could lead to a loss of confidence in the stablecoin, negatively affecting Bitcoin's price.

Moreover, the relationship between Tether and Bitcoin has been a topic of debate among industry experts. Some argue that Tether's growth has been beneficial for the cryptocurrency market, as it provides a stable alternative to volatile digital currencies. However, others believe that Tether's influence on Bitcoin's price is detrimental to the market's overall health.

In response to these concerns, Tether's creators have defended their actions, claiming that Tether is a legitimate stablecoin and that its supply and demand are driven by market forces. They argue that Tether's growth is a testament to its utility and that it has not manipulated Bitcoin's price.

Despite these defenses, the issue of Tether manipulating Bitcoin price remains a controversial topic within the cryptocurrency community. As the market continues to evolve, it is crucial for regulators and industry participants to address these concerns and ensure the integrity of the cryptocurrency market.

In conclusion, the issue of Tether manipulating Bitcoin price is a significant concern for the cryptocurrency community. While Tether's creators argue that their actions are legitimate and beneficial for the market, critics remain skeptical about the potential for market manipulation and the lack of transparency surrounding Tether's reserves. As the market continues to grow and mature, it is essential for all stakeholders to work together to address these concerns and promote a healthy and transparent cryptocurrency ecosystem.

This article address:https://m.iutback.com/blog/19b59099390.html

Like!(746)

Related Posts

- Binance BNB Convert: A Comprehensive Guide to Trading and Utilizing Binance Coin

- Binance, one of the leading cryptocurrency exchanges in the world, has introduced a new feature that has excited the crypto community: the HNT Wallet. This innovative wallet is designed to provide users with a seamless and secure way to manage their HNT tokens, which are the native tokens of the Helium network.

- Can You Buy a Piece of a Bitcoin?

- Use Binance as a Wallet: A Comprehensive Guide

- Bitcoin Mining Smartphone: The Future of Cryptocurrency on the Go

- Binance Own Wallet: A Secure and User-Friendly Solution for Cryptocurrency Storage

- Bitcoin Cash Value: The Impact on Coinbase and the Cryptocurrency Market

- Can You Buy a Piece of a Bitcoin?

- Can I Buy Dogecoin on Binance.US?

- The Price for Bitcoin in 2012: A Look Back at the Early Days of Cryptocurrency

Popular

Recent

Can Bitcoin Exist Without Miners?

Can I Buy Bitcoin ETF on Vanguard?

March 2012 Bitcoin Price: A Look Back at the Early Days of Cryptocurrency

Bitcoin Mining Hardware 1th: The Ultimate Guide to High-Performance Mining Equipment

EFT Bitcoin Price: The Latest Trends and Predictions

Bitcoin Cash Not Available on Coinbase: What It Means for Investors and Users

Binance, one of the leading cryptocurrency exchanges in the world, has introduced a new feature that has excited the crypto community: the HNT Wallet. This innovative wallet is designed to provide users with a seamless and secure way to manage their HNT tokens, which are the native tokens of the Helium network.

The Price for Bitcoin in 2012: A Look Back at the Early Days of Cryptocurrency

links

- Can U Buy Bitcoin on PayPal?

- How to Access My Bitcoin Wallet Backup: A Step-by-Step Guide

- Kaspa Binance Listing: A Milestone for the Cryptocurrency Community

- The Economics of Bitcoin Mining: A Comprehensive Analysis

- Do I Need the Blockchain to Use Bitcoin Core Wallet?

- The Cost of Building a Bitcoin Mining Rig: A Comprehensive Guide

- How to Hack Someone's Bitcoin Wallet: A Comprehensive Guide

- Can I Buy Bitcoin on Chime?

- What is a Private Bitcoin Wallet?

- List All Binance Spot Coins: A Comprehensive Guide